tax lien nj sales

A federal tax lien exists after. The nonresident sellergrantor shall estimate the Gross Income Tax due by multiplying the percentage of ownership times the gain used for federal income tax purposes times the highest rate of tax 1075 for the taxable year provided in NJSA.

Understanding Nj Tax Lien Foreclosure Westmarq

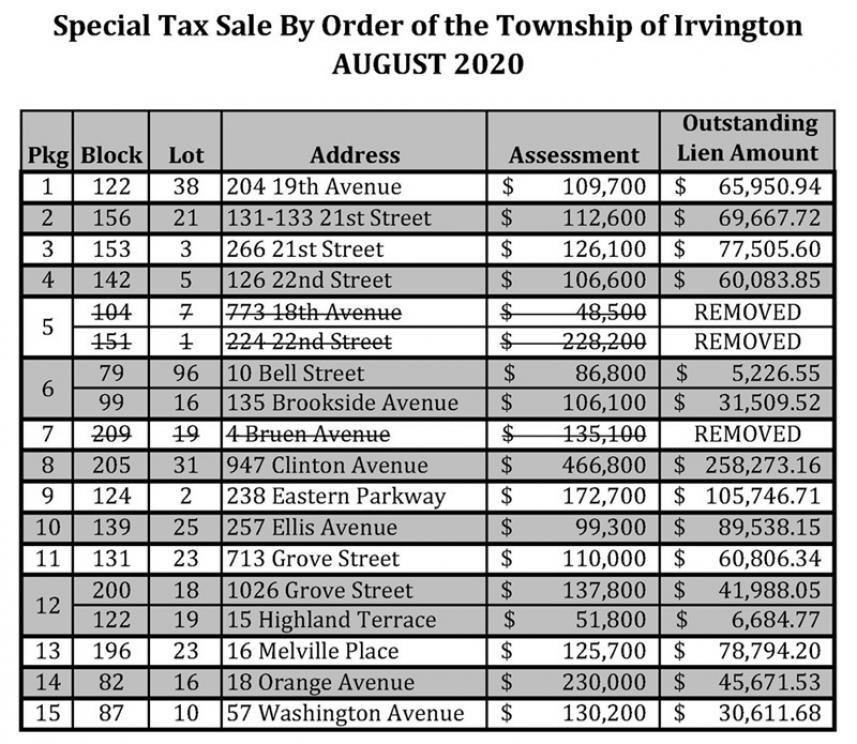

To speed your inquiry on a specific piece of property it is helpful if you refer to the property by its address or docket number which appears in the legal advertisement.

. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. A full schedule of Bid4Assets county tax deed sales foreclosure auctions and government surplus auctions. Property owners who are permanently disabled senior citizens or veterans may qualify for property tax deductions if they meet income and residency requirements.

Keyword Auction ID GO. Research and compare vehicles find local dealers calculate loan payments find your car. El Dorado County CA Tax Defaulted Properties Auction March 31st - 31st.

Sales are conducted Wednesday at 2 pm. Or delivered in person to. Colorado Amendment 64 approved by voters legalizing the sale and possession of marijuana for non-medical use including cultivation of up to six plants with up to three mature.

Tax payments can be mailed to. For more information please contact the Assessment. If youre interested in tax lien investing the first step is finding tax liens for sale at auction.

Property Tax Relief Programs State Aid Offset Guide to Calculating Estimated Tax Bills PL1994 c72 Affidavit of Tax Bill Mailing - MSWord Model the Fiscal Effect of an Accelerated Tax Lien of Tax Levy Sale Post Judgement Interest Rate Table Tax Billing File Layout - 1204 - MSExcel Explanatory Local Finance. Sheriffs Sales. And pictures and video.

To claim your exemptions you must visit a motor vehicle agency. Liens noted on the decedents title shall be paid before a new title is issued unless the lien on the title is being transferred to the sole owner. Sale at Auction Sales at public auction are executed by the Sheriffs Office approximately four months after a judgment is docketed.

The federal tax code expressly states the amount of an unpaid federal tax including any interest penalty or additional amounts or other costs is a lien in favor of the United States upon all property and rights to property whether real or personal belonging to. Both represent sales of homes with unpaid property taxes. 132 Effective November 1 2018.

Expert reviews of cars trucks crossovers and SUVs. A tax lien is a claim the government makes on a property when the owner fails to pay the property taxes. View All Links QuickLinksaspx.

70 Fairton-Gouldtown Road Bridgeton NJ 08302 Tax payments can also be made online. Your local tax agency may be able to provide information on when tax lien auctions take place according to the National Tax Lien Association NTLA. Tax lien sale homes and tax deed sale homes.

A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Direct appeals to the NJ State Tax Court can only be filed if the assessment exceeds 1000000. Do the partial Sales Tax exemption half of the applicable Sales Tax rate and 20000 Sales Tax cap apply to new boats or other vessels sold as.

Sales Tax A vehicle is only exempt from sales tax if the customer indicates on the purchase price line on the reverse side of the title. You must pay New Jersey car sales tax whether you. Sales Tax Information for Remote Sellers PL.

Mount Holly NJ 08060 Phone. Please note the tax appeal filing deadline is April 1 2022If your municipality went through a district wide revaluation or reassessment the deadline is May 1 2022. Tax appeals can be filed annually on a property by the owner on or before April 1st of the tax year.

Notice of the sale is advertised in The News Observer and posted on the bulletin board inside the Salisbury Street entrance of the Wake County Courthouse 20 days prior to the auction date. The Tax Court of New Jersey is located at the Richard J Hughes Justice Complex 25 Market Street Trenton NJ. If there was a lien on the vehicle then Sales Tax is due on the loan amount assumed.

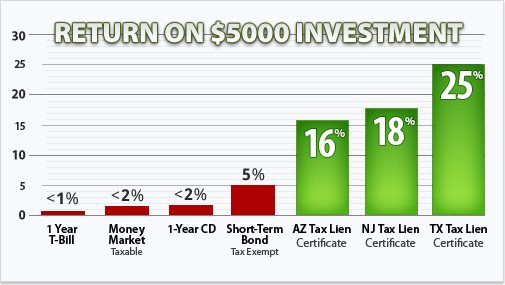

Liens are sold at auctions that sometimes involve bidding wars. Sutter County CA Tax Defaulted Properties Auction March 25th - 28th. Burlington County Foreclosure Sales Listing.

Required Tax Bill Language. The lien protects the governments interest in all your property including real estate personal property and financial assets. Residents are encouraged to contact the Ocean County Tax Boards office via telephone 732-929-2008 for any assistance.

Sheriffs Sales Foreclosures Quick Links. For your convenience property tax forms are available online at our Virtual Property Tax Form Center. Instructions as well as tax appeal forms can be found and printed from our website.

A tax lien sale is when the liens are auctioned off to. Contact your lending institution for more information. Tax Sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the.

The sale date information displayed on this Web page is. If you wish to claim exemptions other than the ones listed below contact the MVC Sales Section of the New Jersey Division of Taxation at 609 984-6206. Autoblog brings you car news.

The judgment of the county board of taxation may be appealed to the Tax Court of New Jersey by filing a complaint with the Tax Court Management Office within 45 days from the date of the mailing of the judgment. Once you know when a tax lien auction is scheduled you can plan to attend. Social Security also should not be reported on the Property Tax Credit Application Form NJ-1040-H.

An appeal must be filed with the Sussex County Board of Taxation the Tax Assessor and Township Clerk. Please feel free to contact the Sheriffs Sales Office at 609 989-6144 or 989-6102. PO Box 240 Fairton NJ 08320.

New Jersey charges taxes and fees when you buy title and register a new or used car. In order for the property not to be considered abandoned the tax lien holder must. There are two types of tax sale homes.

There are several vehicles exempt from sales tax in New Jersey. Check this calendar frequently for new updates. A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt.

After a municipality issues a tax lien. As long as the tax lien holder has carried out certain obligations a property is not considered abandoned property for purposes of the various legal remedies included in the Abandoned Properties Rehabilitation Act NJSA. Puts your balance due on the books assesses your.

Colorado became the second state to legalize going into effect four days after Washington state however it was the first state for legal retail sales to become established.

What Are Tax Lien Certificates How Do They Work

Tax Lien Investing Can You Make Good Money Women Who Money

New Jersey 2021 Tax Lien Sale Deal Of The Week Youtube

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

How To Buy Tax Liens In New Jersey With Pictures Wikihow

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

New Jersey Tax Lien Certificates Deal Of The Week Franklin Nj Youtube

Free Tax Lien Training Ustaxlienassociation Com

How To Buy Tax Liens In New Jersey With Pictures Wikihow

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Gloucester City Tax Sale Information Gloucester City Nj

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

What Are Tax Lien Certificates How Do They Work

How To Buy Tax Liens In New Jersey With Pictures Wikihow